Let’s start this post off with a question:

Can you pay less for Medicare?

Lowering your premiums is no small feat, especially for high-income earners who are subject to Medicare IRMAA.

Read on in this article to learn more about “Medicare IRMAA” and how you can take action to potentially decrease its impact on your nest egg.

IRMAA Increases Your Medicare Premiums

IRMAA stands for Income Related-Monthly Adjustment Amount.

The higher your taxable income, the more likely it is that you’ll pay Medicare Parts B and D surcharges. This factor could add thousands to your Medicare premiums every year.

As a refresher, here is a summary of the differences between Medicare Part B and Medicare Part D:

- Medicare Part B: This coverage is considered “medical insurance” and covers medical services and medically necessary supplies to treat a patient’s health condition. Part B is “elective” and would cover doctors’ services, outpatient care, and other medical services that Part A would not cover. A caveat to understand: Medicare Part A comes automatically at no cost. But, Part B requires that you enroll within a 7-month window when you turn 65 (some exceptions apply). Failure to enroll at the proper time can lead to a lifetime premium penalty. This is just one reason why creating a healthcare plan for retirement is so critical.

- Medicare Part D: This type of coverage is considered “prescription drug benefits” and is typically a stand-alone plan.

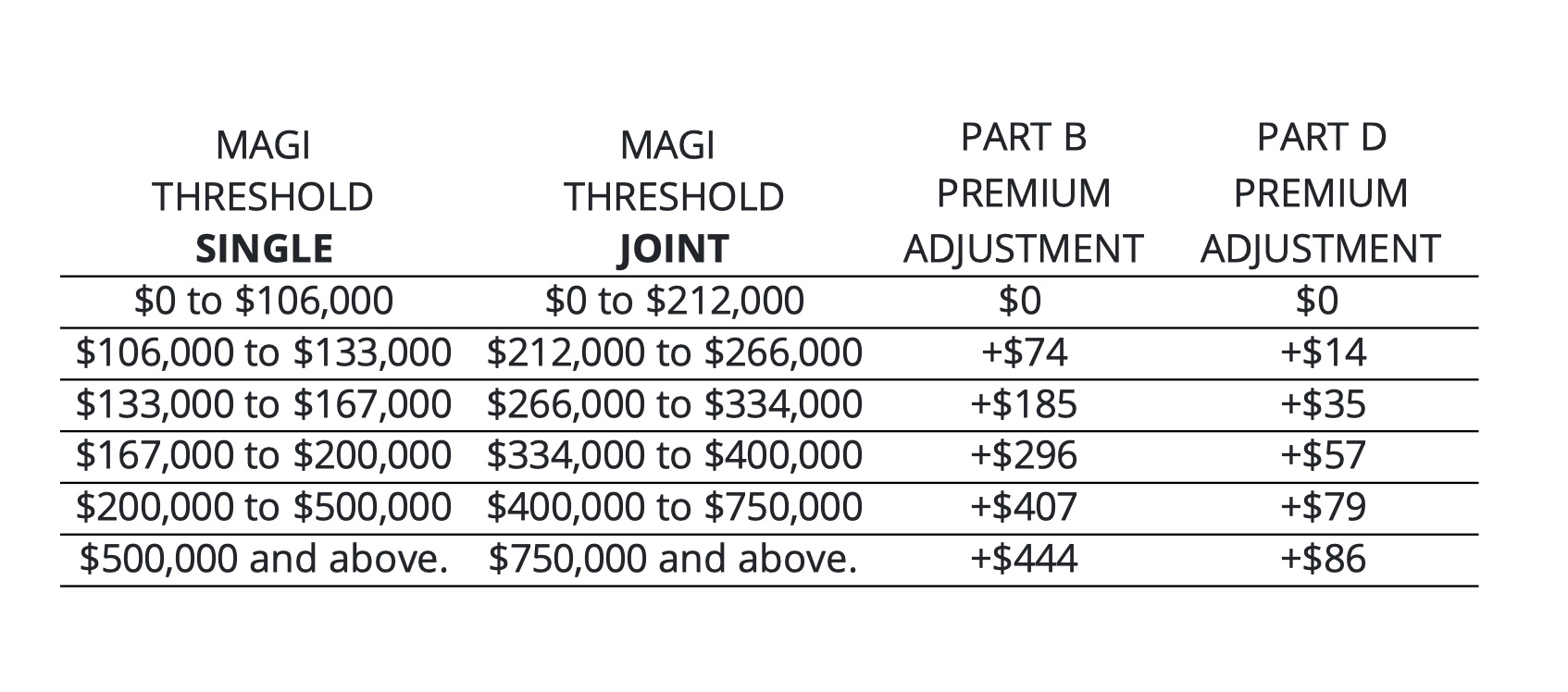

To more fully understand the impact that IRMAA can have on retirees, here is the 2025 table illustrating the different income thresholds:

Without tax planning, large and irregular expenses could push someone unintentionally over the thresholds. Because these brackets are so narrow, it is easy to end up in the middle of the table. An example of a large and irregular expense could be as simple as pulling more funds out of your IRA to create available cash for a new car.

Limit IRMAA Charges And Pay Less For Medicare With These Strategies

The good thing about IRMAA considerations is that there are a lot of proactive planning strategies that can help ensure you are in a good spot. Ultimately, all of these options focus on limiting IRMAA charges so that you pay less for medicare.

IRMAA is essentially an extra charge to your monthly premiums for Medicare Part B and Medicare Part D. It is important to note that there is no surcharge to Medicare Part A, Medicare Supplement, or Advantage Plans.

Below are several planning strategies to consider:

- Sign-up for Medicare Part B on time to avoid added charges

- Make payments with Social Security if collecting your benefit

- Appeal charges

- Strategically defer your income

Let’s look at these last two a bit more in-depth.

Appealing IRMAA Charges To Pay Less For Medicare

Your IRMAA is based on income in the last two tax years. Therefore, if your income has significantly changed between now and two years ago, you can appeal the charges and pay less in Medicare.

Most significantly, this may be the case if you have had a life-changing event that has impacted your income. If this is the case, you would undoubtedly want to notify Medicare and appeal your IRMAA charges. A few major life events that could apply in this case could be marriage, divorce, spouse’s death, loss of job, etc.

Deferring Income To Limit IRMAA Charges To Pay Less For Medicare

Being strategic around deferring income is a tax strategy to consider for many reasons. This is also true when thinking about limiting IRMAA charges.

A few important examples to consider come from Roth IRAs, Qualified Charitable Distributions (QCDs), and income-producing investments (like selling real estate).

High-earners should take advantage of Roth conversions (converting funds from a traditional IRA to Roth IRA) early on in retirement, ideally before you enroll in Medicare. While you’ll need to pay taxes on the conversion, by converting, you effectively decrease the portion of your pre-tax investments. Doing this increases tax-free money and lowers the amount you need to take in required minimum distributions (RMDs) when that time comes.

QCDs present an important charitable giving and tax opportunity for those over 70 ½. QCDs are a charitable donation from your Traditional IRA to a qualified charity. Perhaps one of the most beneficial qualities of a QCD is that you can donate enough to fulfill your annual RMD. By donating your RMD, the IRS doesn’t consider that amount as taxable income. This strategy is most ideal for those at RMD age and charitably inclined.

Finally, if your financial plan has some flexibility on the timing of significant events, deferring certain income-producing investments could be quite helpful in limiting IRMAA charges. For example, if you are thinking of selling real estate, deferring that event will help you avoid raising your income.

Make A Plan To Maximize Medicare

Sometimes triggering some level of IRMAA is unavoidable, given the sources of income that you have.

Doing so is not a bad thing.

However, it is crucial to account for this added expense within your financial plan. By considering IRMAA in this way, you can adjust your investment, tax, and spending strategy accordingly.

Need to know more about Roth Conversions and other strategies to help you pay less for Medicare? Or do you need someone to help execute an IRMAA charge appeal?

Wingate Wealth Advisors can look at your situation and help you choose and execute the most effective strategies for you. Contact us today.